3 Common Tax Filing Mistakes That Could Cost You Thousands | Per…

Q&A with Organizational Pro Peter Walsh + Dermatologist Shares A…

Actor Hank Azaria + Freezer Meals + Artichokes 2 Ways with Rach

See Inside Barbara Corcoran's Stunning NY Apartment + It's Steak…

How to Make Chicken and Lobster Piccata | Richard Blais

Donnie Wahlberg Spills Details About NKOTB's First Ever Conventi…

Donnie Wahlberg + Jenny McCarthy Say Rach Is Such a "Joy" + Look…

The Best Moments From 17 Seasons of the Show Will Make You Laugh…

How to Make Crabby Carbonara | Rachael Ray

Rach Chats "Firsts" In Flashback From Our First Episode Ever In …

How to Make Apple-Cider Braised Pork Chop Sandwiches with Onion …

Rach's Chef Pals Say Goodbye to Show in Surprise Video Message

How to Make Sesame Cookies | Buddy Valastro

How to Make Tortilla with Potatoes, Piquillo Peppers and Mancheg…

How to Make Shrimp Burgers | Jacques Pepin

How to Make Spanakopipasta | Rachael Ray

Andrew McCarthy Chokes Up Discussing Emotional Trip to Spain wit…

Celebrity Guests Send Farewell Messages After 17 Seasons of the …

Celebrity Guests Send Farewell Messages After 17 Seasons of the …

Andrew McCarthy Teases Upcoming "Brat Pack" Reunion Special

Michelle Obama Toasts Rach's 17 Years on the Air With a Heartfel…

2020's extended tax season has come and gone — but Chris Hogan, author of Everyday Millionaires, has tips that can save you some major bucks come next year's tax season.

According to the personal finance expert, there are three big tax mistakes that can cost you *thousands* of dollars. He breaks down the common pitfalls and explains what you should do instead, depending on your situation.

TAX MISTAKE #1: Getting A Refund

A tax refund is not free money, Chris points out. "When you get a refund, you've allowed the government to hold onto your money for a year interest free," he says. "I want people to get their money sooner to be able to use it."

Here's how it works. In 2019, the average tax refund was around $2,869, according to Chris. "Instead of letting the government hold onto that money, if you were to make adjustments to your W-4, you could get $239 extra dollars a month. If you got that, you could start to invest it," he says.

Chris uses two vases to demonstrate visually what would happen if every month, you put that money in your Roth IRA and invested it in a good mutual fund. The blue sand represents the $239, and the green is the return on your investment you'd earn. The average return for an IRA invested in mutual funds is 7 - 10%, so by the end of the year, you'd have $2,976.

If you wait until you get your return to invest, you've spent a whole year waiting on that money and you only end up with $2,869. "You get all of your money back, but you don't get any of the interest," Chris points out. So you're missing out on $107.

You control this by the way you fill out your W-4 form for work, Chris explains. You should talk to your HR or accounting department to find out the right way to fill it out so that you break even, rather than getting a refund or having to pay.

RELATED: The 4 Questions Financial Experts Are Asked All The Time — Answered!

TAX MISTAKE #2: Claiming The Wrong Filing Status

The next mistake is claiming the wrong filing status and not accounting for life changes — like buying a house, getting married or having a baby — that change your taxes.

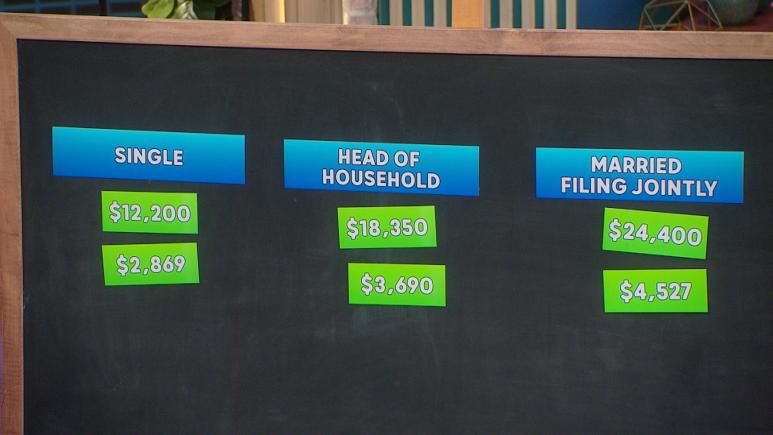

There are three main filing statuses: Single, Head of Household, and Married Filing Jointly. The standard deduction you can take is different for each. Based on an average annual income of $50,000, Chris shows you how claiming the correct filing status could get you a bigger refund.

For this example, Chris assumes the individual withheld $7,214 to get the average refund mentioned above. If they filed as single, they'd get a refund of $2,869. If they filed as HOH, they'd get a refund of $3,690. If they file as married filing jointly, they'd get a refund of $,4527.

Single and married are pretty self-explanatory, but according to Chris, head of household is where a lot of people mess up. And if you do mess up, it can cause you to under-pay your taxes, then face a penalty and interest if you end up paying late. So how do you know if you qualify as head of household?

- You have to be single.

- You have to support qualified dependents.

- Children must be under 19 or under 24 if a full-time student. You must have provided more than half of the person's financial support for the year.

- If you have a relative who relies on you for most of their financial assistance (parent, grandparent, great aunt) you can claim them as a dependent as long as no one else claims them and they cannot have a gross annual income above $4,200.

- People think that if they are married and the only one working, they qualify, but this is not true, Chris says. Per the IRS, "Your spouse is never considered your dependent."

- You have to pay more than half the cost of keeping up a home.

- This includes the mortgage, utilities and even food.

TAX MISTAKE #3: Missing Out On Valuable Deductions & Credits

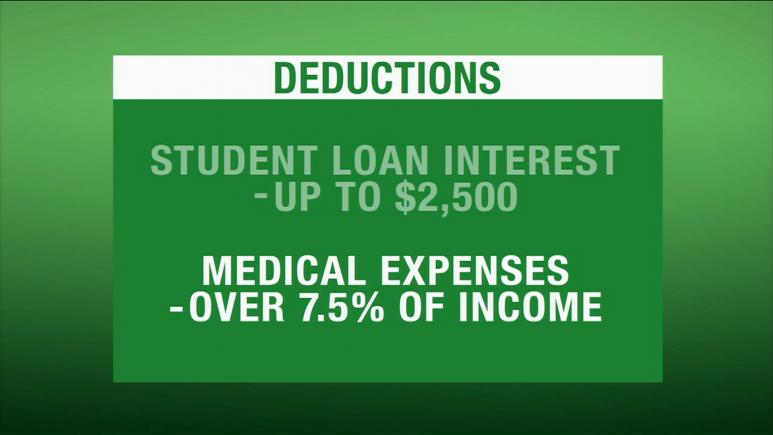

Your filing software or tax pro can help make sure you claim all the deductions and credits that you do qualify for. Skipping this step because it seems complicated or because you're not sure you'll get any money back could end up costing you hundreds or even thousands of dollars, Chris stresses. He highlights a few deductions that many people don't know about:

- DEDUCTION: Student Loan Interest

The student loan interest deduction lets you deduct up to $2,500 from your taxable income. You do not have to itemize to take this. This deduction may be a great way for you to get money back in your pocket if you are legally obligated to make interest payments (parents, if a loan is in a student’s name, you cannot deduct interest paid by them), Chris says.

- DEDUCTION: Major Surgery Or Illness

The deduction for medical expenses is one of the few tax breaks currently available to individuals. You do have to itemize your deductions to claim this. Medical expenses can be deducted if they were greater than 7.5% of your adjusted gross income last year, Chris explains. The average household income is around $50,000, so if you made $50,000, you can deduct medical expenses in excess of $3,750. We're talking about medical bills that weren't covered by insurance or your FSA — these are out-of-pocket costs for things like big surgeries, dental procedures, hospital care, nursing and long term care.

Of course there's more to these and any other deductions, so you may need to talk to a tax pro or do a little more research to make sure you qualify.

"[With] taxes, there are a lot of nuances. The main thing is don't do it alone," Chris says. "It's all unique, so there's no cookie-cutter approach. You need to talk to a professional to give you the right guidance."